Business managers and entrepreneurs have always adopted performance measurement as a fundamental principle in business management. KPI, Key Performance Indicators, rappresentano una metrica per valutare la prestazione generale o quella di singoli processi e delle operazioni che li compongono; offrono dunque una fotografia in tempo reale dell’andamento delle prestazioni aziendali e supportano la gap analysis tra le prestazioni in atto e gli obiettivi da raggiungere.

The economic context characterized by complexity and uncertainties, new social phenomena, the rapid emergence of new technologies, regulatory evolution, and the need not just to adapt to changes but to anticipate them, increasingly focus managers' and entrepreneurs' attention on risk management.

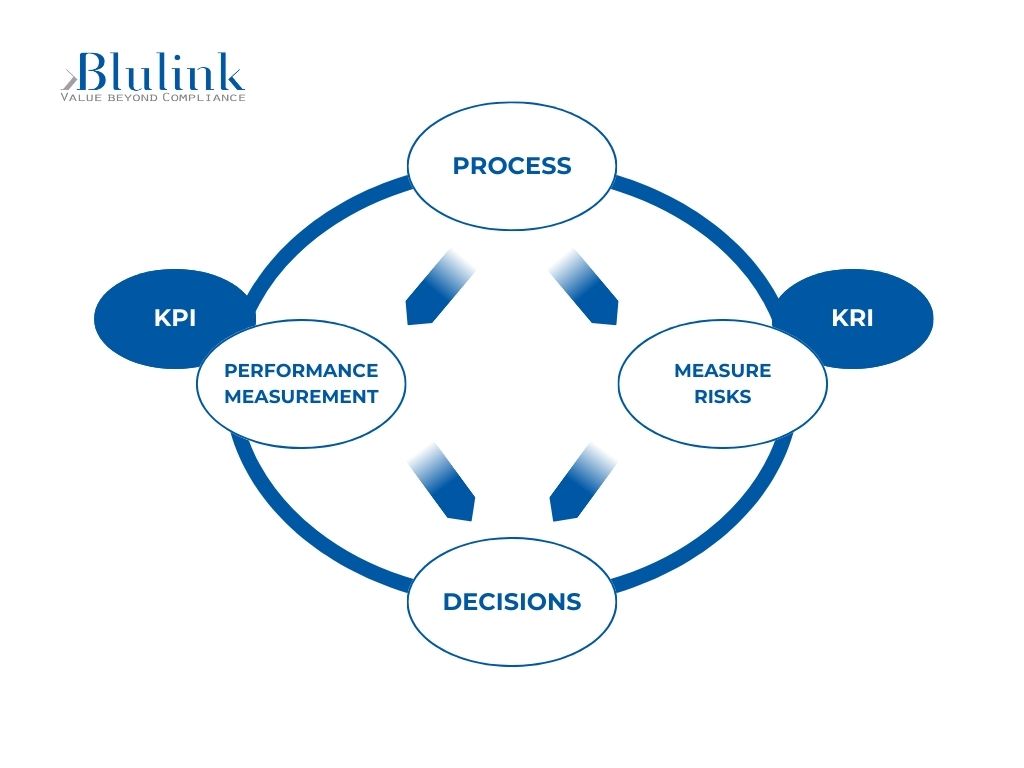

The approach of "Risk Based Thinking" introduces Key Risk Indicators (KRIs) - measures to identify the potential presence, level, or trend of a specific risk factor (see the articles: "Risk Based Thinking - Beyond Compliance to Generate Value" and "Risk Based Thinking - Application to Health and Safety of Workers").

KRIs have a predictive connotation; exceeding a predefined threshold should trigger mitigation actions, particularly concerning significant impacts that could compromise goal achievement.

From these preliminary considerations, two questions emerge:

- What substantial differences characterize KPIs and KRIs?

- Is there a type of relationship between KRIs and KPIs that, when manifested, generates value?

The obvious difference between KPIs and KRIs concerns the object of measurement, whether it's performance (P) or risk (R); however, there is a deeper and more significant difference regarding the nature of the indicator (I).

KPIs provide ex-post measures, i.e., information on whether an objective has been achieved or not, with potential gap analysis; KRIs provide ex-ante measures, i.e., they anticipate events that could impact business performance and consequently goal achievement.

The subsequent assertion also addresses the second question regarding the relationship between KRIs and KPIs: the risk indicator predicts the performance indicator.

Consider some examples of KRIs with possible relationships to KPIs:

- Personal management

- Voluntary turnover rate (KRI) as an index of company attractiveness (KPI)

- Percentage of sick days due to injuries (KRI) as an index of workplace safety (KPI)

- Product Compliance Management

- Number of complaints (KRI) as representative of product quality (KPI)

- Number of disputes (KRI) as a measure of customer management capability (KPI)

- Internal Audit Management

- Number of non-conformities identified (KRI) as an index of proper functioning of business processes (KPI)

- Number of unresolved non-conformities (KRI) as representative of business efficiency (KPI)

L’applicazione reiterata del modello “Risk Based Thinking con l’utilizzo di metriche per la misurazione delle prestazione (KPI) E’ così possibile arrivare alle migliori decisioni per ridurre le incertezze, garantire i risultati e mitigare gli impatti negativi sull’azienda. |  |